3 Multicurrency Wallet App Business Success Stories [2024]

Looking to simplify managing multiple currencies? A multicurrency wallet app could be your next venture.

This tech-based solution allows users to hold, exchange, and manage different currencies all in one app. Integrated with cryptocurrency support, such apps facilitate transactions across borders without the hassle of multiple accounts or high conversion fees, appealing to both travelers and global businesspersons.

The growing demand for streamlined financial solutions positions this idea as both relevant and lucrative. Creating this app involves collaborating with developers, ensuring robust security features, and partnering with financial institutions for seamless integrations.

For those tired of the complexities of traditional banking, a multicurrency wallet app represents a modern, user-centric alternative. With the rise of digital currencies, the timing has never been better to jump into this market and innovate.

In this list, you'll find real-world multicurrency wallet app business success stories and very profitable examples of starting a multicurrency wallet app business that makes money.

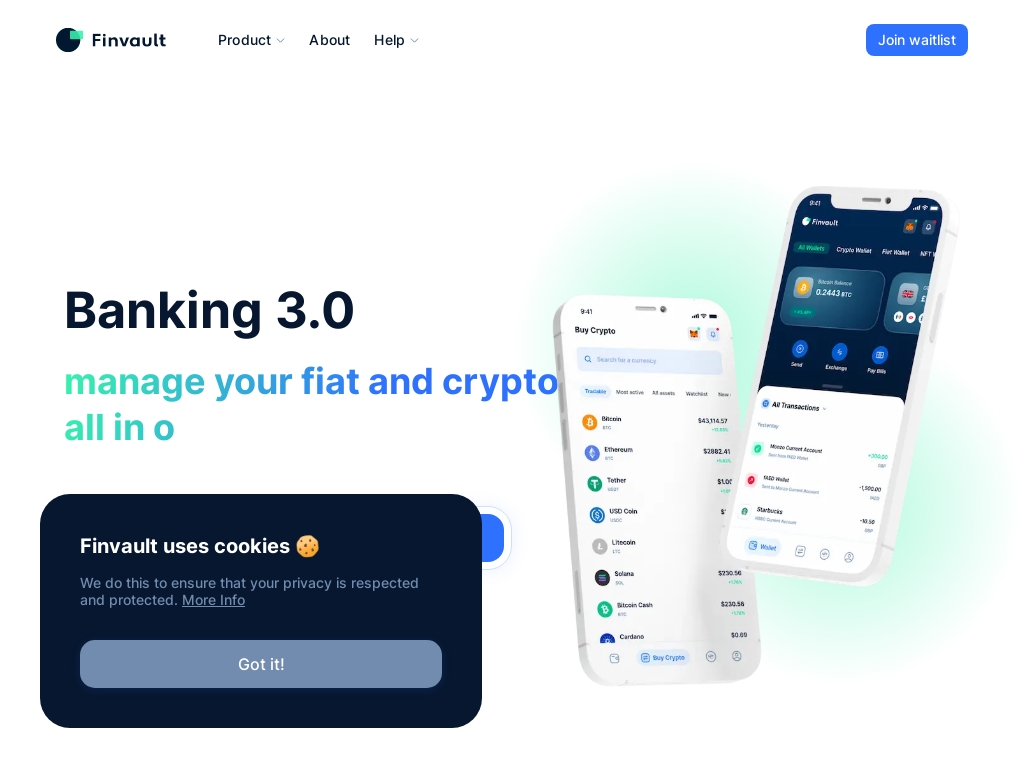

1. Finvault ($2.64M/year)

Punit Thakker, the CEO and co-founder of Finvault, came up with the idea for the digital wallet after recognizing the need to bridge the gap between traditional finance and decentralized finance (DeFi). With a background in fintech and cybersecurity, Punit and his co-founder Christian Papathanasiou aim to create an equitable financial ecosystem by providing a platform that allows users to manage all their bank accounts and crypto in one place. They have built a skilled team of developers and designers to bring their idea to life and are preparing for a phased launch into the UK and European markets.

How much money it makes: $2.64M/year

How much did it cost to start: $700K

How many people on the team: 13

Finvault co-founder Punit Thakker discusses the digital wallet's mission to financially connect users worldwide by providing one platform to manage all bank and crypto accounts; the platform is due to launch with initial features, including a crypto exchange, and is projected to achieve a customer acquisition cost of $10.75 and lifetime value of $4,800 based on a two-year lifecycle assumption.

2. HollaEx ($420K/year)

Adrian, the co-founder of HollaEx, came up with the idea for his open-source crypto software startup in the early days of crypto around 2016. Starting with an app that connected bitcoin enthusiasts, the focus shifted to exchange technology as the industry grew. HollaEx has now evolved into a general-purpose crypto service, providing a white-label exchange software that allows businesses to enter the crypto world easily.

How much money it makes: $420K/year

How much did it cost to start: $10K

How many people on the team: 13

HollaEx, an open-source crypto software startup, evolved into a general-purpose crypto service and created a white-label exchange software with a one-day launch, resulting in a revenue of $420k per year as of 2021, with a focus on exchange technology and tackling key crypto infrastructure solutions like wallet tech, exchange hosting, and white-label services.

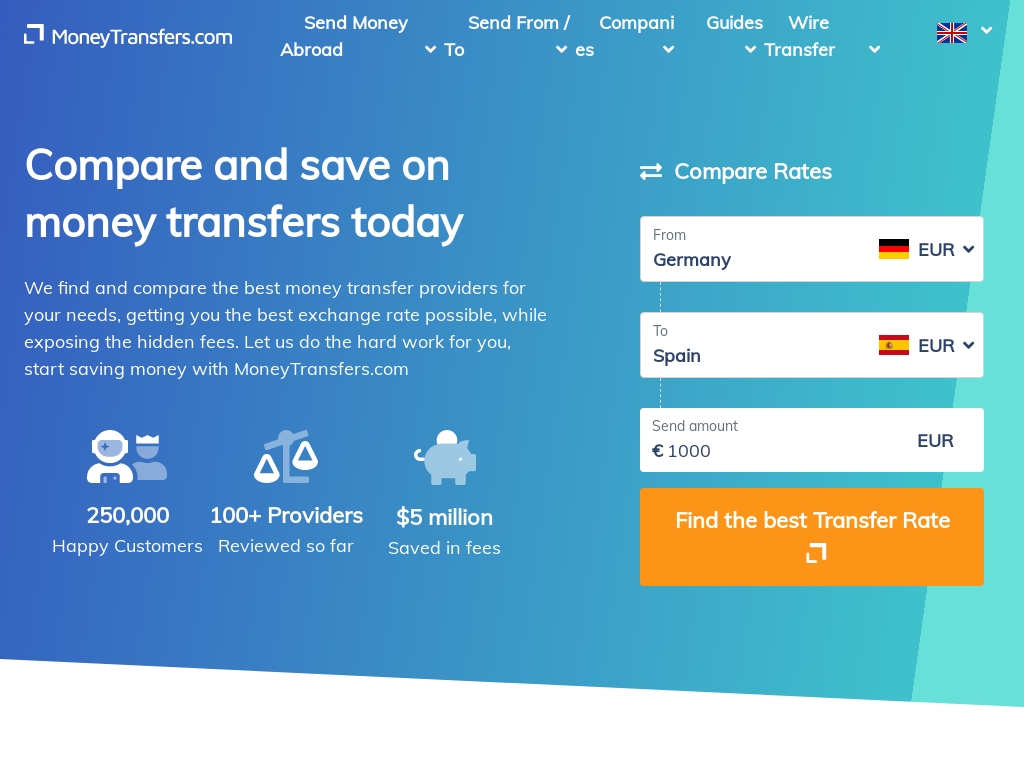

3. MoneyTransfers.com ($138K/year)

Jonathan Merry, founder of MoneyTransfers.com, came up with the idea for his business after experiencing the confusing and opaque world of online remittances firsthand. He realized there was a gap in the market for a money transfers comparison site that would provide users with transparent and affordable options. Since its launch in 2019, MoneyTransfers.com has generated an average monthly revenue of £2.5m and has become a trusted brand in the industry.

How much money it makes: $138K/year

How many people on the team: 12

MoneyTransfers.com is a comparison website which has grown to generate average monthly revenues of £2.5m and 2,500 new customers for partners each month since founder Jonathan Merry took the plunge in 2019; despite only experiencing organic acquisition in the last year, the company's solid traffic and range of digital PR campaigns aimed at the expat community have contributed to the company's establishment as a trusted brand in the money transfers space.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.